As the wine industry labours to reduce the burden of surplus wine, Vinpro and SALBA joined forces to set up a new outlet for its products: grape juice for the manufacture of ciders.

During 2020, the Covid pandemic and multiple national lockdowns severely hampered the sales and export of South African wine. With fewer sales, the loss of valuable opportunities, and continued bottlenecks at the Cape Town Port, the wine industry entered 2021 with a surplus approximately 300 million litres, prompting Vinpro to launch urgent appeals for relief.

The industry’s worsening situation soon made international headlines and prompted an outpouring of local and international goodwill. But ultimately, it was up to local producers and organisations to find new ways to adapt.

New house rules

In July 2021 the alcohol industry’s representative bodies began making a case before the regulating Wine and Spirit Board to allow the use of wine grapes in ciders, in a further bid to ease the pressure. The initiative was spearheaded by members of the South African Liquor Brand-owners Association (SALBA), and Vinpro, representing the South African wine industry.

The standard only allowed apples and pear fruit to be used as concentrate, and yet a significant share of apple concentrate used in local ciders was being imported, while pear concentrate is considered to be less cost effective. The proposal argued the imported apple juice concentrate could easily be replaced with grape concentrate without adversely affecting the other industries or the quality.

The appeals were effective new legislation, gazetted in July 2022, expands the cider and perry product standard to allow other fruit bases to be used in cider production, provided at least 75% of the fruit used is derived from apples.

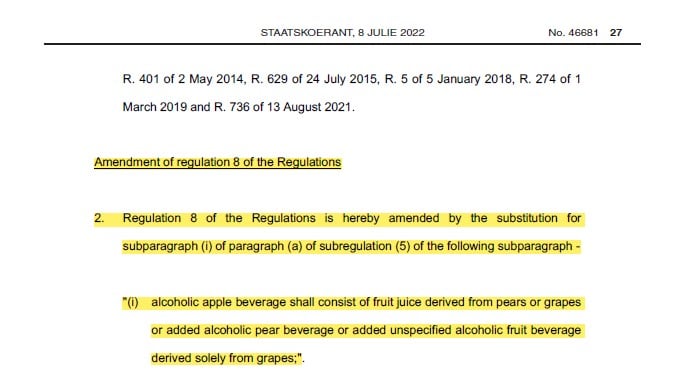

The relevant section of the amendment.

Cider: a viable alternative

The amendments give cider producers more flexibility in the fruit bases they use to produce a cider without impacting on the taste and quality of our world-renowned ciders, says Kurt Moore, CEO of SALBA.

As a net importer of apple and grape juice concentrates – mainly from Argentina – the increased local grape concentrate supply could also assist to reduce imports of both, and allow cider producers to substitute pear with grape juice.

“Grape concentrate is mainly utilised for sweetening of beverages and foodstuffs, and a significant share of SA’s apple juice concentrate is utilised in cider production,” adds Carin Fouche, head of corporate strategy at Distell, the second-largest cider producer in the world.

“Adding one of SA’s largest fruit industries (grapes) means we can potentially source more fruit concentrate locally as more supply becomes available.”

Better late than never

The production of concentrate provides a welcome alternative for surplus wine, that relief will not necessarily extend to dry white, which makes up the bulk of the current surplus. “It should rather be seen as providing a greater suction power that can help stabilise the prices somewhat,” says Christo Conradie, Vinpro manager for wine business.

Distell estimates between 10-20% of excess supply can be reduced via the new channel. “Reducing excess wine supply via grape concentrate production is certainly not the only lever to remove the surplus, but can make a meaningful difference,” Carin says.

“The change in product standard still enables us to produce a high-quality cider product as SA requirements are above several international cider producing country benchmarks.”

(Un)favourable conditions

Although global and local sales volumes have now mostly recovered to pre-Covid levels, prices for grapes and wine remain under pressure. The economic fallout of the Ukraine crisis, coupled with high energy inflation, is likely to add to the surplus and hamper the market’s post-COVID recovery.

Grapes for wine are typically priced well above grapes destined for concentrate, but the continued excess supply of wine (generic white wines in particular) creates significant downward pressure on these bulk wine supply prices, which puts the wine industry in a precarious situation.

“Consumer spend on non-durable goods (ex food) retail is already negatively impacted by high food and transport inflation,” Carin says. “So all together if these trends continue, it could drive juice pricing from wine grapes to be competitive for grape concentrate application.”

Plan ahead

But the process is not without its challenges for wine producers. Cellars who delivered concentrate to the plants in Grabouw or Elgin sometimes had to contend with scheduling conflicts and other logistical challenges due to the overlapping seasons.

Surplus wine also needs to be properly channelled and prepared to go the concentrate route, and wines cannot be reallocated to concentrate after the season.

“Wine cannot be used for concentrate,” explains Ferdinand Appel, MD of uniWines. “Alcohol and sulphur would have to be removed and sugars have already been fermented. The only way to cost-effectively prepare surplus wine for concentrate involves that those grapes must already be earmarked in the vineyard at press time.”

“Juice with a low sulphur content is then made from these grapes which are delivered for making concentrate. This means that a lower volume of grapes is automatically received from either a poor quality or lower sugar grape that would end up as surplus wine in the market,” says Ferdinand.

“Less wine is therefore produced, and the product is instead channelled to making concentrate.”

Cellar and producers must try to make market-oriented decisions to ensure they’re not left with excess, uncontracted wine stocks before the new season arrives. Pre-season contracting to supply concentrate is key. “But herein lies the challenge,” says Christo. “Cellars may be hesitant to contract, believing the surplus won’t be that bad.”

Worth a look

Now that it has been implemented by government, all local cider and perry producers can utilise the new legislation. With, volumes increasing over 50% in 2021 according to IWSR data and cider products showing rapid growth in Africa, it may be worth investigating.

To meet the demands of the cider market, producers should engage with the cider manufacturers to understand their requirements and plan their next harvest accordingly, Kurt advises.

“The fact that grape concentrate is now allowed in the production of ciders, creates the opportunity for the wine industry to use grape products/cultivars from which wine would normally be made and whose prices are most under pressure,” adds Ferdinand.

For its part, uniWines will consider supplying juice for concentrate if supplying the product supports the company’s long-term strategy, Ferdinand says. “If the concentrate can achieve good prices, and the prices show greater stability, it can ensure sustainability for the producer and cellar.”

Watch: A blast from the past

Click here to get the latest copy of WineLand Magazine, or subscribe to our monthly newsletter.