During 2023, tastric collected data from over 45 South African wineries, including renowned names like De Grendel, DGB, Thelema and Durbanville Hills (Heineken Group). Its annual South African Industry Report for 2023 combines insights from over 40 000 wine enthusiasts and 158 nations.

Engaging customers

tastric is a German startup founded by two friends, Max Schiefer and Moritz Schreiner, who introduced an innovative method for wineries to collect and analyse customer data directly from their events, tasting room or restaurant. The system feeds this data to a cloud-based CRM system, where it is used to gain insights on consumer behaviours and preferences, allowing wineries to make informed, data-driven decisions.

“We basically build the entire customer communication for the winery,” Max says. “With this dataset you know what the customer wants and is willing to pay for a certain wine. That means you can automate your communication, instead of just sending out campaigns on a monthly basis. The interaction is fully automated and a lot more detailed than is possible with a personalised mailing or campaign.”

Since customers get exactly what they want when they want it, this interaction usually leads directly to a measurable increase in sales. “Wineries always think that the best way to deal with a new market is by having a good, strong importer that does wonders and builds them up in a certain market, but actually what they should do is internalise the entire communication and therefore also the brand building.”

These days, this form of direct communication entails social media and email and tastric clients have been able to increase their email subscriber base by 800% on average, with retention rates of over 65%.

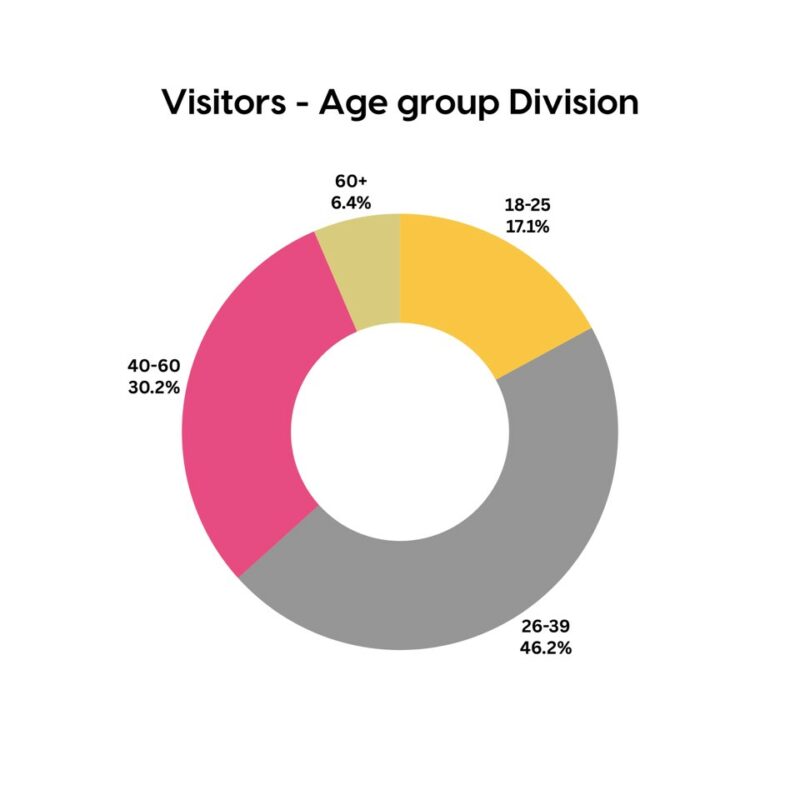

Proportion of winery visitors by age group (tastric 2023 report).

Visitor experiences

The tastric report is based on data collected from around 45-50 South African wineries using tastric’s data collection system which engages visitors to provide information via user-friendly interactive surveys strategically placed in the participating wineries.

The data collected comprises roughly 2.6 million data points. About 27% of winery visitors participated, including international visitors from across 158 countries, which makes the dataset widely representative.

Top international visitor countries were the UK (21%), Germany (16%), the US (11%), and Netherlands (7%). But 73% of the responses were from domestic (South African) visitors, highlighting the importance of the local market.

Another good sign is that visitor numbers remained high even out of season – a distinct shift from the patterns observed in 2022, according to the report. “This emphasises the importance for wineries, tasting room managers and sales representatives to maintain consistent sales strategies throughout the year,” Max says.

“Implementing smart sales strategies not only enhances the customer experience but also fuels increased sales and cultivates customer loyalty.” — Moritz Schreiner, co-founder of tastric.

Domestically, recommendations (word-of-mouth) was a major driver of winery visits in Stellenbosch and Constantia, while guided wine tours played a larger role in others. The Franschhoek Wine Tram in particular stood out as pivotal for cellar visits in Franschhoek, equal to the effect of recommendations. “Nearly a quarter of visitors to the valley came from the Wine Tram and organised tours,” Max says.

Social media had a more modest influence, but played a larger role in Constantia. “Young people from Europe and America come to Cape Town and visit wineries in Constantia and Stellenbosch rather than Franschhoek, preferring trendy places with good views and even music rather than more established wine farms.”

The fact that a large percentage of visitors indicated that they simply lived nearby or explored the area should be a wake-up call to wineries about the importance of exceptional visitor experiences to stimulate endorsements and loyalty.

Taste profiles

Emerging trends include more experimentation/innovation from wineries, moving away from so-called ‘flagship’ wines (which is not necessarily the most expensive wine), creating overall tasting experiences beyond just wines, and lighter style wines with less oak influence. This shows up in an increased interest in varieties like Sémillon, Viognier, and Pinot Noir.

While Chenin Blanc and Pinotage declined in popularity, varieties like Sauvignon Blanc, Merlot, and Pinot Noir saw increased interest. Preference for Chardonnay remained flat. “It could be the case that the marketing efforts for Chenin Blanc from an international perspective was just not as good as in 2022.”

For red wines, Cabernet Sauvignon remained static as the top preference, while Merlot grew 6.1% and Pinotage showed a 10% decline. Consumers seems to be drifting back to more international varieties, even when they’re experimenting. “There’s lot of focus this year to try to overcome macroeconomic challenges by being creative and thinking outside the box, especially from a winemaking point of view.”

Yet there’s also a strong consumer demand in the R100-R250 price bracket both for daily drinking and premium wines, especially for reds. “While daily-drinking white wines are very evenly spread between the below R100 to and R100-R150 category, the majority of daily red wines were in the R100 to R150 category – nearly 60 percent. That means customers are more likely to spend more money on red wines in the same category.”

While the R100-R250 range dominated, there was notable consumer demand for premium red wines above R250. Wineries can develop or position higher-end tiers to capture this market, while also optimising their pricing in the R100-R250 category. “There is a greater willingness to pay for a red wine in this category, but prices don’t reflect that. Red and white wines in the same range are often priced the same,” Max says. “We need to change that. Producers can easily increase the price by a couple of rand – R10 or so, maybe R20 or R30. If people are willing to spend a bit more, you can make more margin.”

Cap Classique/sparkling wines are in high demand domestically, but consumers are less willing to pay premium prices. “There should be a lot more marketing efforts and branding into the Cap Classique category to make sure that people who are buying in a R250 or R350 category don’t opt for a cheap Moët or Veuve Clicquot, which are mass-produced products, and rather go to their local wineries and get for instance a Kleine Zalze Vintage Brut or Haute Cabrière Blanc de Blanc. That’s something the wine industry needs to focus on in the domestic market.”

The tastric report provides valuable insights into the preferences, price sensitivities and behaviour of domestic and international wine consumers in South Africa, highlighting the importance of maintaining consistent sales strategies throughout the year, adapting approaches according to seasonal fluctuations and understanding the demographics of both local and international visitors.

“Wineries are encouraged to leverage digital channels, collaborate with local tour guides, wine distributors and influencers, as well as invest in exceptional visitor experiences and optimise online visibility to attract and retain visitors.”

Introducing tastric