Santam Agri: The South African wine industry was hit by a series of alcohol bans and supply chain issues in 2021. This came after the industry had just managed to lift its head following a prolonged period of weak prices.

Despite this, the sector still managed to grow total export volumes by 22% in 2021 and this upward trend will hopefully continue in the 2022-23 season.

South Africa is currently the eighth largest exporter of wine in the world. It’s imperative that farmers protect wine farms by having the right policies in place.

Hanlie Kroese, head of segment solutions at Santam Agriculture, says, “We know your farm is important to you, regardless of its nature or size. As your partner in agri, we aim to make insurance even more accessible, affordable, and appealing. We will continue to invest in effective risk management to make a real difference in helping you create a sustainable future.”

In the evolving risk landscape, it’s imperative to take out the necessary insurance to protect products and goods destined for countries abroad, as well as safeguard valuable crops and other assets such as cellars or restaurants.

As your partner in agri, Santam aims to make insurance even more accessible, affordable, and appealing.

Santam: Protecting your crop and value chains

Wine and grape producers are particularly exposed when it comes to fire, hail, wind, excessive rain and frost that could potentially damage fruit, says Kroese.

She cautions that, in addition to natural disasters, wine producers and farmers should also ensure their plant material, trellis, fencing and irrigation systems are adequately insured.

Don’t forget your assets

Owners of cellars also need special insurance to guard them against losses, which could be substantial in some cases, says Kroese.

“Contamination, accidental loss of or damage to aged wines, malicious damage to wine, as well as the collapse of bottles, wine barrels, shelves and attachments to the tanks (catwalks) are all risks that could potentially cause liabilities costing millions of rands. Accidental Damage Cover can provide indemnity for these losses or damage.”

With South Africa’s export market predicted to grow due to global shortages, it makes sense to mitigate prospective losses and invest in effective risk transfer.

Wine is a very fragile product that can be damaged by heat, light, physical damage to bottles, or even during the bottling process itself.

Moreover, wine and grape producers and farmers may, from time to time, need to recall certain products. With product recall insurance in place, producers are covered for:

- Formal correspondence and advertisements in the media to communicate the recall;

- Transport of the recalled products to the insured’s property;

- Investigations; and

- Sorting and/or abolishing recalled products.

Progressive farmers need protection for their crops and assets against the risks affecting modern farming.

Today’s progressive farmers need products that cater for the insurance of all their crops and assets against the risks affecting modern farming. Kroese concludes, “Santam Agriculture, the leader in crop insurance in South Africa, has therefore invested in continued research into science crop damage in order to adequately advise brokers and clients on world-class solutions.”

Santam Agriculture is the right partner

Santam is the only short-term insurer with 80 years’ experience in crop insurance and 91 years’ experience in asset insurance.

Santam Agriculture is a dedicated business unit with the agricultural business broker and farming community as its primary focus.

Santam Accolades include:

- Santam is the first South African insurer to join ClimateWise – an international network formed by leading insurers worldwide to influence debate and decision-making on climate change.

- Santam won the Best Personal, Commercial and Corporate Short-term Insurer awards at the 2009 Financial Intermediaries Association’s (FIA) Awards.

- Santam was voted one of South Africa’s top brands in the business-to-business category for short-term insurance at the Sunday Times Top Brands Awards (2009).

- Santam won the Best Company To Work For award in the category for large companies in the Deloitte Best Company To Work For competition.

- Santam was voted the top short-term insurer in the country and the second best company overall in terms of exceptional customer service in the Ask Afrika Orange Index Service Excellence Survey.

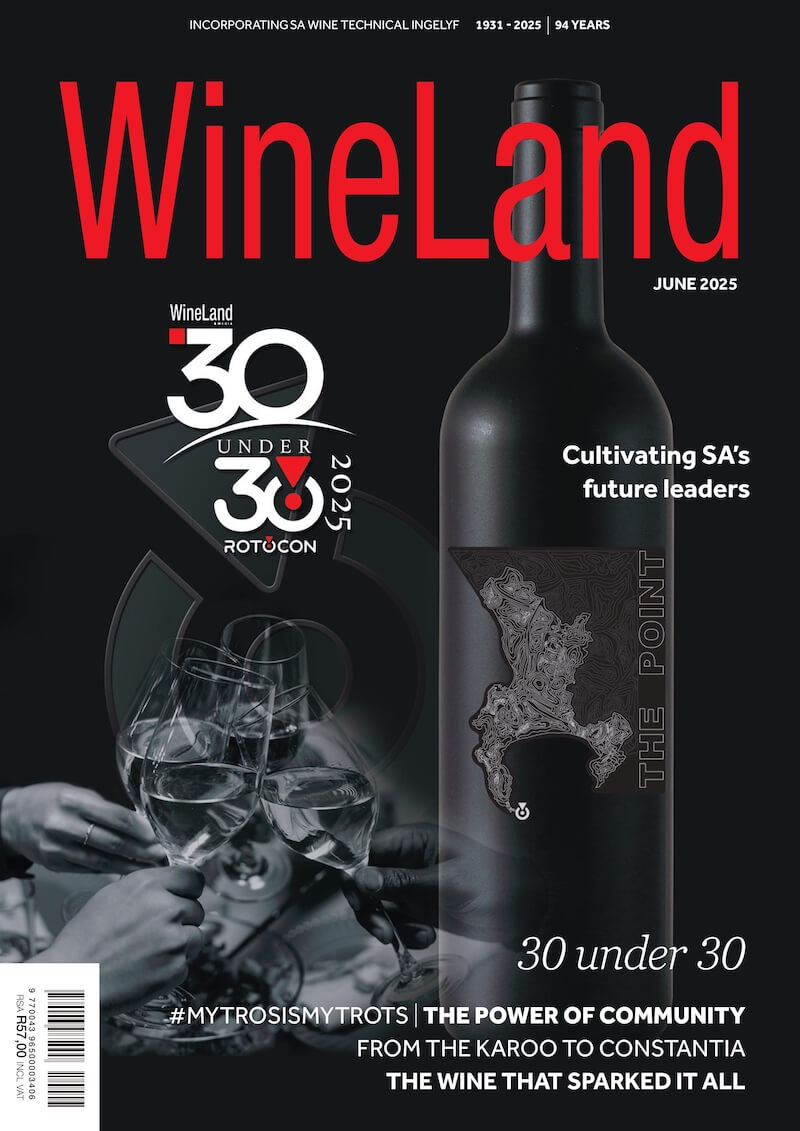

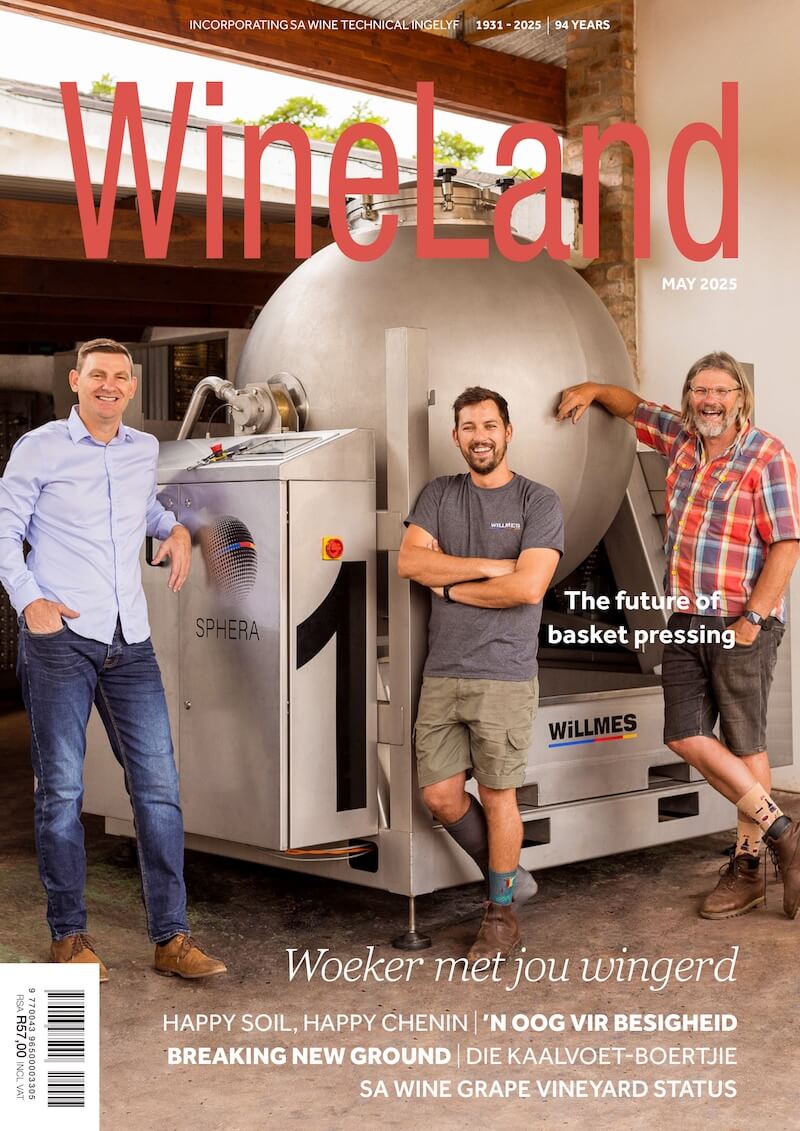

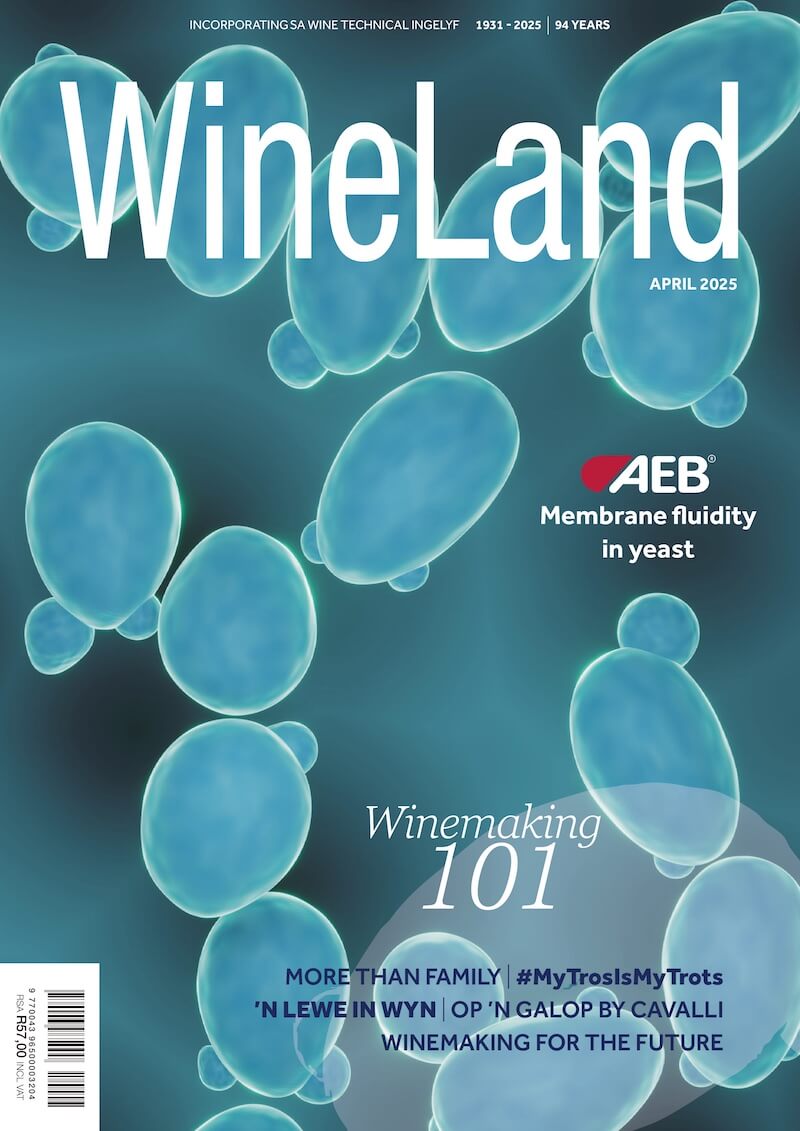

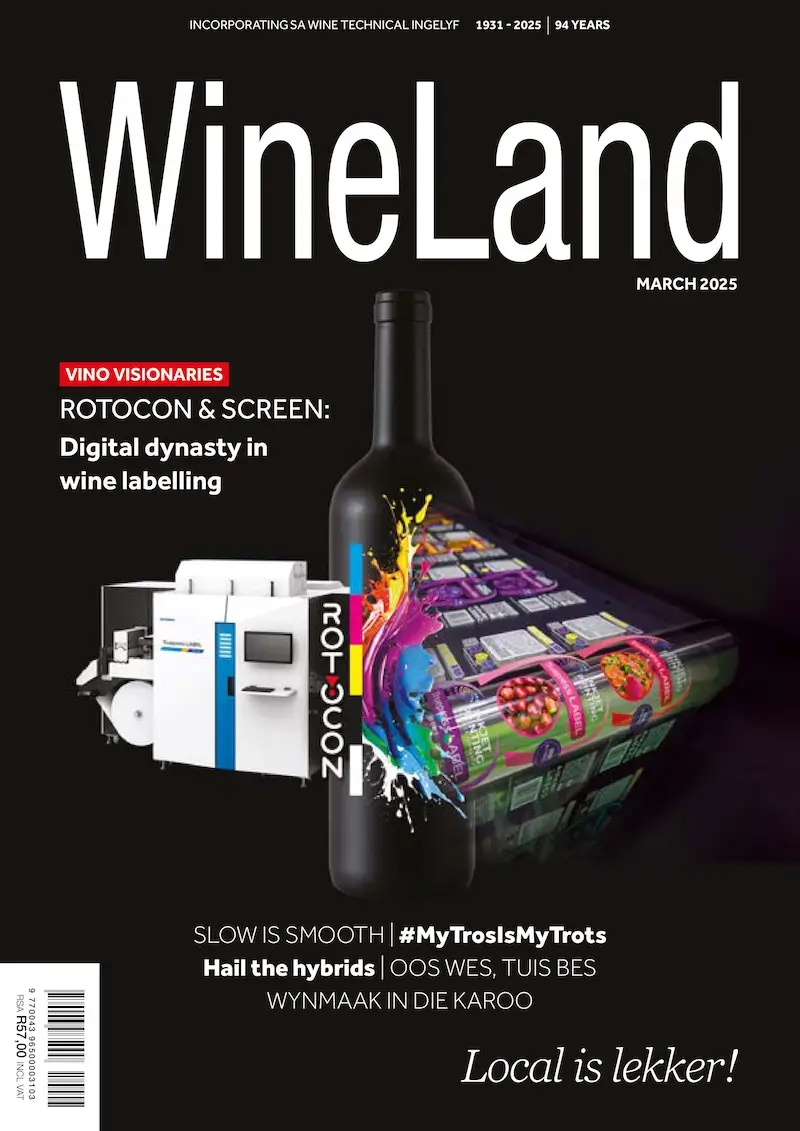

To get your copy of WineLand Magazine, click here.