In recent years, fine wine has become an increasingly lucrative investment. According to the Knight Frank Luxury Index, the world’s super-rich are collecting bottles of the world’s finest vintages more than ever before. Wine has even overtaken collectable cars as a popular luxury investment.

In recent years, fine wine has become an increasingly lucrative investment. According to the Knight Frank Luxury Index, the world’s super-rich are collecting bottles of the world’s finest vintages more than ever before. Wine has even overtaken collectable cars as a popular luxury investment.

What is a fine wine?

The fine wine we are discussing here is an investment wine. It is one that is naturally recognised and established for its high quality. Now that fine wine investing is on the rise, this is wine that is considered a financially sound investment. Its wine that is an investment in your future.

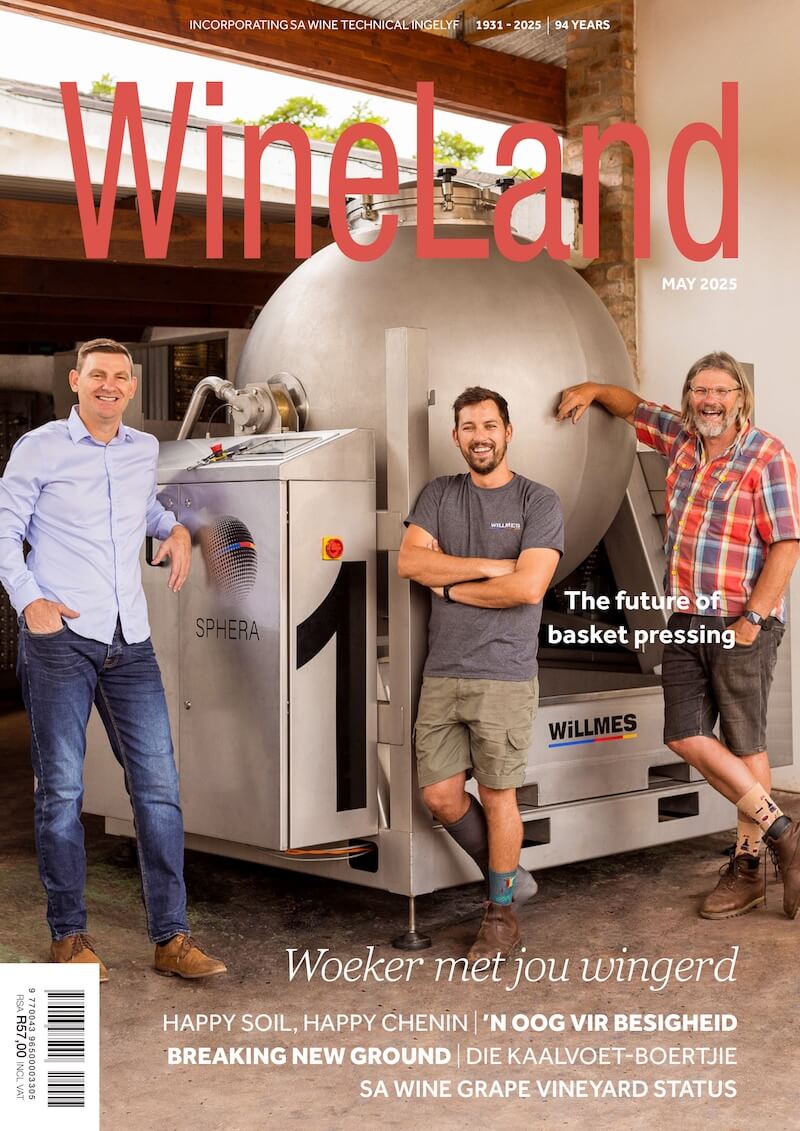

The luxury wine market is a small market that has been built and curated by wine makers, collectors and aficionados.

A wine to invest in should be one of undeniable quality. Fine wines require a lot of work. Creating a ‘fine’ or ‘luxury’ wine takes time and patience; careful cultivation, terroir-focus and ageing. There is also an important factor of rarity required by fine wines. These are not bottles you can easily come-by.

An investment wine should represent exceptional quality, age-worthiness and timelessness.

The world’s most profitable investment wines come from the Bordeaux region of France; an area notable world-wide for fine wines.

While still not on the same level as international players such as Bordeaux, the South African fine wine industry is one of the best.

South African Fine Wines

South Africa is renowned for producing world-class wines and in recent years, the industry has seen a number of winemakers engaging with the new fine wine category. It is an area that is beginning to boom thanks to growing enthusiasm for investing in bottles of the finest vintage.

There have been a number of new releases, such as Plaisir de Merle’s Charles Marais 2013, which has joined the ranks of the more established cohorts of Vilafonté, De Toren, the Sadie Family Columella and Kanonkop’s Paul Sauer.

Over the past few years, South African wine has been sparking the interest of International experts. Compared to the rest of the world, South African wines are still relatively cheap compared to wines of similar quality from the rest of the world. This makes them an attractive (and delicious) investment.

It will take time before the South African wines reach Bordeaux-level investment status.

At the moment in South Africa, high tier fine wine is still produced in small quantities. This scarcity is helping to drive the market and interest.

As mentioned, the industry is beginning to flourish in South Africa and the growing enthusiasm has encouraged a couple of wine estates to begin focusing on producing fine wines long term. An example is De Toren who are famed for their exceptional Bordeaux-style blends.

How to invest

There are a good few investment-level wines currently being produced in South Africa. People looking to break into investing in fine wine should be prepared to spend R5000 – R10 000 on an initial portfolio.

When choosing wine to invest in, the experts suggest that classic reds are worth the price tag. Look for wines that improve with age – these prove to be the the pillar of the fine wine industry.

Buy wine online from www.wineofthemonth.co.za